Table of Content

There are plenty of different variables to contemplate, and it can be exhausting to know tips on how to compare totally different provides. The financial savings fee is also influenced by informal establishments, similar to how a particular tradition views debt or values materials possessions. Cultures oriented towards consumerism and conspicuous consumption have decrease financial savings rates. In the United States, consumption spending constitutes approximately 67% to 70% of GDP and the financial savings rate is round 7%. Changes within the amount of interest the market generates can affect the financial savings rate.

The scoring formulas bear in mind a number of information points for each financial product and service. In the United States, Personal Saving Rate correspond to the ratio of personal income saved to personal net disposable earnings during a sure time frame. On the opposite hand, a extra structural change in saving and spending habits with "scarring" in customers can have intense repercussions for the financial system. This occurred in the course of the Great Recession and may exacerbate secular stagnation, which "retains rates of interest and development and inflation all low for a protracted time," stated Greene. The Annuity Expert is anonline insurance coverage agency servicing consumers throughout the United States.

Savings Accounts Vs Cash Market Accounts

An IRA financial savings account is a kind of retirement account that allows you to save money for retirement. In addition, the money in your IRA grows tax-deferred, meaning you don’t have to pay taxes on it till you withdraw the money in retirement. With a traditional IRA, you get a tax deduction on your contributions. With a Roth IRA, you don’t get a tax deduction on your contributions, but you possibly can withdraw the cash tax-free in retirement. Institutions such because the efficient institution and enforcement of private property rights and the control of government corruption are inclined to encourage savings.

With just $100 needed to open an account and no monthly upkeep fees, savers of all kinds might discover it to be an interesting choice. In the previous yr, the treasury price calculation has decided the nationwide rate cap. To close a financial savings account, you have to contact your bank or credit union and request that the account is closed. You might have to provide identification and sign a kind authorizing the closure of the account. Once the account is closed, you will not have the flexibility to access the funds.

Financial Savings Bonds

"That implies that the stimulus continues to be in their accounts and it will be spent. Part of it's been spent however there's more to come back," he stated. "There's not much alternative for many individuals to exit and spend money," said Megan Greene, a senior fellow at Harvard Kennedy School. "With retailers all closed and everybody locked up, the 'shopportunities' have dried up. That speaks to a kind of demand shock."

We are an impartial, advertising-supported comparability service. Although most Americans have some form of savings in place, they don’t at all times have a lot of money of their accounts. And completely different individuals also have various preferences in relation to where they put their money. Saving cash is a brilliant transfer, as it can assist guarantee it is possible for you to to fulfill your bills should you lose your job.

How Usually Do Rates Of Interest On Savings Accounts Change?

High-yield savings accounts can nonetheless be a great option for incomes interest in your deposited funds regardless of the risks. Using savings accounts is a good idea, and they are secure too. They are protected for up to $250,000 on the FDIC banks and NCUA credit score unions. Anything that influences the speed of time desire will affect the financial savings fee. Economic situations, social establishments, and particular person or population traits can all play a role. Economic situations such as financial stability and total income are important in determining financial savings charges.

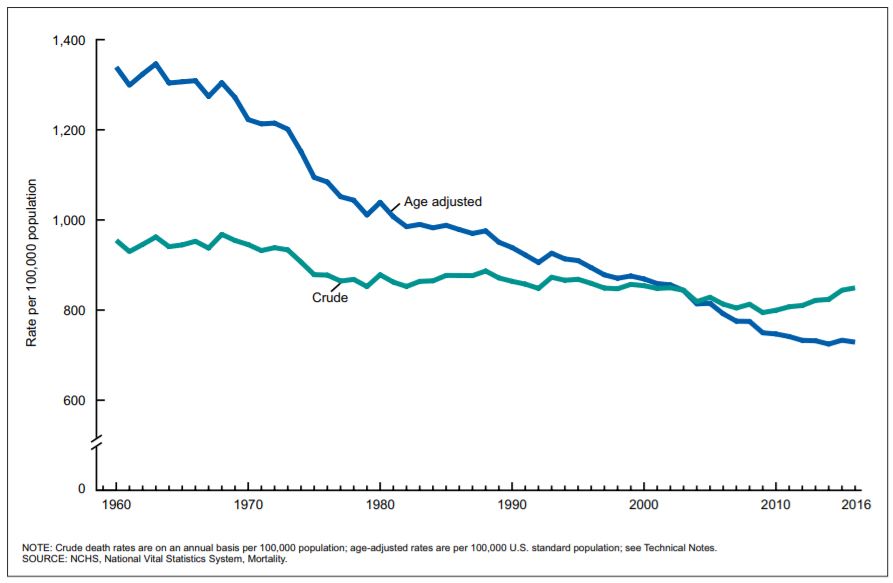

The private financial savings fee hit a historic 33% in April, the us This price — how a lot people save as a share of their disposable income — is by far the highest for the rationale that division started tracking within the Nineteen Sixties. A financial savings account is a checking account where you'll be able to deposit cash and earn curiosity. A health savings account is a type of savings account that can be utilized to pay for medical expenses. HSAs are solely out there to people who have high-deductible health insurance plans. Money contributed to an HSA is not taxed, and the money in the account can be used tax-free to pay for certified medical bills.

A savings account is a bank account the place you can deposit money and earn interest on the steadiness. Savings accounts sometimes have larger interest rates than checking accounts, however there are usually restrictions on how typically you'll find a way to withdraw cash from the account. Checking accounts are extra versatile relating to withdrawals, however the rates of interest are usually lower.

While dividends are taxed as revenue, buybacks are taxed as capital gains—making them a preferential selection for traders. Given these advantages, stock buybacks have outpaced dividends over the last twenty years. Spurring this wave of buybacks are sturdy company money flows—sitting near $2 trillion—and a 1% excise tax on buybacks approaching in 2023. This indicators a vote of confidence from corporations on their financial health whilst a recession looms large.

The IRS considers any interest earned on a financial savings account to be taxable. If you earn interest out of your savings account, you'll be required to submit a 1099-INT kind to the IRS. Whether opening an account online or in a financial institution or credit score union, you’ll likely be requested for related information. That’s as a end result of all banks need to adjust to sure guidelines and rules for new account openings. The minimum amount needed in a savings account to keep away from a month-to-month maintenance payment.

In anybody calendar year for one Social Security Number, you may purchase up to $10,000 in EE bonds. The limit applies to the Social Security Number of the first particular person named on the bond. If you utilize the money for qualified larger schooling expenses, you may not should pay tax on the earnings.

The main function of a financial savings account is to develop your money over time and hold the funds accessible when they’re wanted essentially the most. Saving refers to strategies of accumulating capital for future use by either not spending a part of one’s revenue or cutting down on certain costs. Saved cash could also be preserved as money, placed on a deposit account or invested in various monetary instruments. Investing usually incorporates some level of risk which implies that a part of the invested money may be gone. The instance of a comparatively protected investment can be saving bonds, debt securities issued by the U.S.

Sign Up NowGet this delivered to your inbox, and more information about our services. This was largely pushed by the elderly inhabitants, based on Swonk. Pre-Covid-19, child boomers had been pulling back on spending amid a surge in mortgage restructuring, that means the older inhabitants was saving money every month and never spending. Wood likens the current savings to the post-9/11 era, when consumers went via a quick period of "paralysis" after the assault, adopted by a sturdy recovery in spending.

This may affect which merchandise we write about and the place and the way the product appears on a web page. Here is a listing of our companions and here is how we make money. U.S. Treasury payments can be a viable short-term funding, as Treasurys can be found with maturities of four, eight, thirteen, 17, 26 and fifty two weeks.